- In the past, when it came to patent portfolio management, most people in this field regarded patents more as a right of protection, and not really as a method of monetization.

- As a result, the focus often ended up being simply on applying for more and more patents and maintaining them after they had been granted, and not on managing and monetizing the patent portfolio itself.

- Nowadays, as people are becoming more aware of the importance of monetizing patent assets, the time has come to transform this old patent portfolio management thinking to new patent portfolio management thinking.

- In fact, it’s time for patent portfolio management to be recognized as one of the most important parts of the entire patent lifecycle management process.

Table of contents

- Patent Portfolio Management in the Past

- Some Examples of Successful Patent Portfolio Management from Different Industries

- Common Patent Portfolio Management Problems

Patent Portfolio Management in the Past

Patents as Inventory, Not Assets

Those working in the field of financial asset management have long known how to make effective use of their assets, such as stocks, cash, bonds, gold, futures, and options, as well as how to use their portfolios to generate a larger income.

By contrast, those in the IP world have traditionally taken a more conservative approach to effectively monetize their IP assets, to say nothing of using them to create an even larger benefit.

Look at it this way: an organization that owns a large number of patents but doesn’t know how to manage these assets is just like a person who has plenty of money but doesn’t understand how to generate even more income by investing it wisely.

To speak plainly, people in the past tended to take a more passive approach to patents. They understood that by owning them, they had the right to exclude others from using, manufacturing, selling, or importing products covered by this protection. This, of course, was correct, but actually a far too limited view.

Several questions could be raised:

Are all of these patented inventions being commercialized? What’s the ROI (Return on Investment) of these patents? Do they really exclude, or even stop others from using, manufacturing, selling, or importing covered products?

If the answers to the above questions are negative, then the patents could then be considered to be more like inventory, which only brings expenses (application fees and maintenance fees), without actively generating revenue.

In fact, patents are assets, just like financial assets, and we should actively make the best use of every single asset we have to bring in more income.

“Life is like a snowball—all you need is wet snow and a really long hill.”

– Warren Buffett

In the same way, patents are like a snowball—all you need are quality patents and a really long hill.

To explain, the start of the product or technology development process is just like standing at the top of the hill, and this is when you should begin to think about what your patent portfolio will look like. For example:

What’s the claim scope of the patents? Will these patents be commercialized? How will the patents be deployed in different countries? Should we invest more—or less—in a certain technology? Can we claim royalties from others or enforce our rights easily? Most important of all, do we have enough high-quality patents?

As time goes by, you can gradually develop your own patent portfolio management approach, in alignment with the overall corporate strategy, and hone it to best fit the market, all the while continuously adjusting it over time.

In this way, over the long run, you will be able to create a very powerful patent portfolio and one that is able to generate great benefits.

The Patent World Needs More “Jacks-of-All-Trades”

In addition, managing patent assets requires the ability to integrate information and knowledge from different domains. For instance, a patent professional should not only be familiar with engineering but also patent law. It could even be said that combined knowledge of both engineering and law is required.

Unfortunately, in a traditional organization, a patent professional may excel at writing technical documents and applying for patents, but he/she may have little to no domain knowledge about other professions, such as research and development (R&D), manufacturing, sales, marketing, or product management. As a result, this person may not know what kind of benefit these things can bring, or what else might be needed to strengthen the business.

It is also rare to find a patent professional who can connect people from different departments and align everyone’s work toward one target. Sadly, this can cause siloed communications in an organization, with people from different departments failing to communicate effectively and even, at times, withholding resources or information from one another.

For wise patent portfolio management, patent professionals must not only be familiar with a singular profession but also have a comprehensive understanding of the operations of each department in an organization. Thus, more “jacks-of-all-trades” are needed, since these are the people who are versatile enough and possess the necessary cross-domain knowledge to properly manage a patent portfolio.

What’s more, they should be good at applying the MECE (Mutually Exclusive and Collectively Exhaustive) principle, and they should be able to transform the symbols, mathematics, and algorithms into words, sentences, and paragraphs utilizing sophisticated skillsets and rigorous logic.

With the help of jacks-of-all-trades, or with a team of portfolio managers who can work across different departments, the people on a team or in an organization can work together more closely, gain a bigger picture of the importance of a patent portfolio, and create even greater value.

It Is Not a Singular Action

From a patent lifecycle perspective, patent portfolio management doesn’t simply end when a patent is granted, nor at any singular point during a prior art search, state-of-the-art search, patent clearance search, patentability search, or invalidity search, or after enforcing a patent’s rights.

Many people mistakenly believe that patent portfolio management involves only part of the actions above, or they think that managing the active patents is enough.

The truth is that successful patent portfolio management involves a larger scale of decisions, starting from product research and development, through the patent application, prosecution, enforcement, and until the end of life of the product or until the patent has expired. The decisions made during this period are all part of patent portfolio management, and this cycle will continue as the next generation technology or product carries on from the previous generation.

Indeed, there is never any exact ending nor any definite boundaries when it comes to domain knowledge. In other words, patent portfolio management should always be done with a lifetime concept in mind, on the basis of “patent lifecycle management,” and the strategy should be adjusted according to the needs of the organization in the industry.

Some Examples of Successful Patent Portfolio Management from Different Industries

Even though many misconceptions about patent portfolio management do exist, it is still possible to identify some industries in which better patent portfolio practices have been developed. Some examples have been listed below:

Pharmaceutical Industry

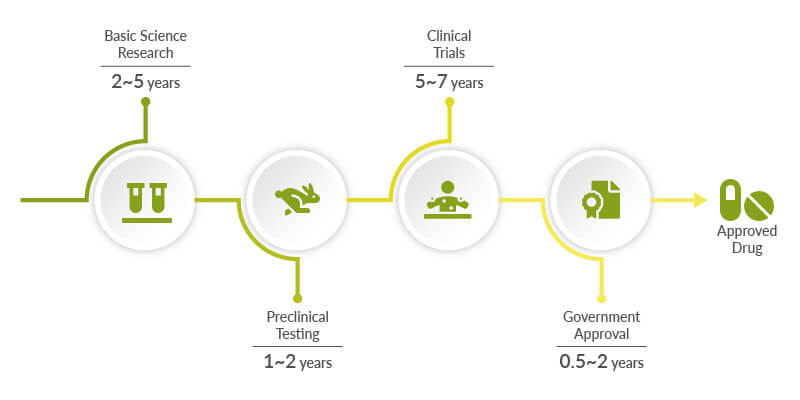

The first example is the pharmaceutical industry. This industry is usually highly complicated because of the tremendous time, expense, and human resources needed in the normal decade-long product-development process.

Effective patent portfolio management ensures that a return on investment will be realized in the long-run, and it is also key in excluding competitors or free-riders from the market.

At each stage in a product’s development, a pharmaceutical company should consider patent filings in order to protect their ideas and maximize the potential for commercialization. For example, while a medicine is still under academic research in the Investigational New Drug (IND) stage, a pharmaceutical company can start to file provisional applications for its core patents in order to protect these ideas, especially if there will be an opportunity for commercialization in the future.

Yet, it may take ten years for a medicine to go to market. So, even if a patent is granted, the remaining life may end up being limited to less than ten years, and a return on investment may not be fully recouped.

As a result, those in the pharmaceutical industry may end up continuously applying for patents for chemical modifiers, pharmaceutical preparations, and analogs in order to protect the core medicine and to extend the lifecycle of the patent portfolio.

The hierarchical structures that are widely found in organizations in the pharmaceutical industry are another factor making patent portfolio management more complex.

An organization, for example, may even have multiple hierarchical structures, extending from its headquarters out to multiple overseas divisions. At the same time, each hierarchical layer of an organization may have its own patent portfolio manager, with each managing his or her own region’s patent portfolio.

However, it should be noted that a single medicine is covered by three patents on average, which is usually quite manageable; even if we include the patent families, the size of the patent portfolio still remains manageable.

Generally speaking, the patent portfolio managers in this industry usually have established knowledge, skills, and experience, but they are often in need of good managerial tools and solutions.

Medical Devices Industry

The second example is the medical devices industry, which has a wide range of products from several companies, such as GE, Philips, Siemens, and Medtronic. In this field, several technologies from different domains are involved, including optics, displays, data, mechanics, semiconductors, bios, and computer sciences, and each product comprises multiple domains of knowledge.

Therefore, it is crucial that patent portfolio managers have a broad knowledge of different domains so that they can discover potential monetization opportunities and align them with the company’s long-term business strategies.

For deployment in this patent landscape, consideration cannot only be given to a single domain but rather the focus must be on integrating with other domains. As a result, at least twenty claims must often be written to cover as many fields of application as possible.

Since the patent landscape in this industry is broad and deep and requires a lot of research, the organization usually needs a large team to manage the whole patent portfolio.

The primary goal of these patent portfolio managers is to beat the competition by using various patent filing and litigation strategies. If they cannot lead the market, it will be hard for them to sustain long-term revenues and higher margins. As a result, patent licensing is not common in this industry, and patent enforcement is more often used to exclude competitors.

Standard-Essential Patents (SEPs)

The companies and organizations that develop standard-essential patents have strong foundations in research and development and in the creation of standard and non-standard patents.

For these entities, patent licensing is the fundamental business model for creating revenue, rather than commercializing their own products or services. The standard-setting organizations such as 3GPP and IEEE build Technical Specifications (TS) to enable follow-up for the participants.

For these participants, building a team of patent portfolio managers who are capable of complicated patent portfolio management is necessary to ensure the long-term sustainability of the patent licensing business model.

Since this type of business heavily relies on royalties, it is crucial to spec-in patents to technical specifications, thus forming standard-essential patents that can claim royalties from others who manufacture or use the technology involved.

A well-known example of this kind of company is Qualcomm, which receives US$1.15 billion quarterly from its technology licensing business. This San Diego-based telecommunication standard solutions provider and chipmaker dropped all of its patent lawsuits with Apple in April of 2019.

It is believed that the termination of these litigations will bring Qualcomm’s revenue back to normal—or even increase it—as the emerging 5G technology is going to be deployed widely across the world in 2020.

Another good example is the Scandinavian giant in the telecommunications industry—Nokia. Although the company has lost its market share in mobile devices with the rise of Apple’s iPhone, it still receives considerable revenue via its patent licensing business from networks, software, IoT, and consumer electronics.

In Nokia’s official financial report for Q3 and January-September 2019, it states that:

We have a large patent licensing business that is sustainable and cash generative over time, with opportunities to enter new growth segments.

Regarding the patent numbers, the report also states that:

Shortly after the quarter ended, Nokia announced it has declared more than 2,000 patent families to the European Telecommunications Standards Institute (ETSI) as essential for the 5G standard, reflecting its continuing leadership in cellular technology R&D and standardization.

Common Patent Portfolio Management Problems

Despite the fact that patent portfolio management has been conducted successfully in some industries (as seen above), there are still several other industries in which the rules for patent portfolio management have yet to be well established.

Why is this so?

Starting from an understanding of how the old patent world worked, we can dig out and highlight some of the problems we have observed, which are summarized below:

- There is no practical or even theoretical basis for patent portfolio management — For the entire 545 years of patent history, a comprehensive theory about effective patent portfolio management has been lacking. What’s more, the proper methodology for patent portfolio management has not yet been created, and every organization has ended up doing this in its own way.

- There is no well-established environment for patent professionals to work and collaborate closely with each other — Traditionally, people haven’t worked together on product or technology development. Instead, the process was divided into smaller phases, with each person starting his or her own tasks based on the previous results. Working in such a siloed environment causes wasted resources, repeated communication, and interrupted management.

- There are no adequate patent portfolio management tools or solutions that enable people to conduct effective patent portfolio management and collaborate with others. — This may have originated from the traditional “waterfall-like” work environment that separates people away from one other and makes it less likely for them to communicate effectively with their colleagues.

Unfortunately, because no adequate theory, methodology, tools, or solutions have been developed, and because a “quantity over quality” approach to patent applications has been widely adopted, too many low-quality, low-value patents have been generated in the IP industry.

According to Patentcloud’s data, the amount of high-quality and high-value patents that most companies have less is than 10%. The result? Wasted resources and unnecessary investment.

These worthless patents also make it difficult for companies to effectively manage their patent portfolios since these low-rated patents cause extra expense and extra human resources to be required.

This situation also occurs in research institutes and academies, patent firms, law firms, and patent offices, causing each to have to invest extra resources in patent prosecution and litigation.

Worst of all, these low-quality, low-value patents increase the amount of noise in patent databases, which, as a result, affects the efficiency of patent portfolio management.

How can these common patent portfolio management issues be fixed? Stay tuned for the second part of this series, where we will look in detail at:

- The essentials of patent portfolio management

- How the new concept of Patent Lifecycle Management (PLCM) can be of assistance

- Why competitive analysis is important

- What solutions and tools you can use to get started